SECURITIES AND EXCHANGE COMMISSION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No.) Filed by the Registrant ¨ Filed by a Party other than the Registrant ¨ Check the appropriate box:

|

| | |

¨ | | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a- 6(e)(2) ) |

| |

xý | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material Pursuant to §240.14a-12 |

IPG PHOTONICS CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

| | | | | |

¨ý | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1)(1 | ) | | Title of each class of securities to which transaction applies: |

| | |

| | (2)(2 | ) | | Aggregate number of securities to which transaction applies: |

| | |

| | (3)(3 | ) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| | (4)(4 | ) | | Proposed maximum aggregate value of transaction: |

| | |

| | (5)(5 | ) | | Total fee paid: |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ |

¨ Fee paid previously with preliminary materials.: transaction computed pursuant to | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11 (set forth0-11(a)(2) and identify the amount onfiling for which the filingoffsetting fee is calculated and state how it was determinngpaid previously. Identify the previous filing by registration statement number, or the Formform or Scheduleschedule and the date of its filing. |

| | |

| | (1)(1 | ) | | Amount Previously Paid: |

| | |

| | (2)(2 | ) | | Form, Schedule or Registration Statement No.: |

| | |

| | (3)(3 | ) | | Filing Party: |

| | |

| | (4)(4 | ) | | Date Filed: |

You are cordially invited to attend our annual meeting of stockholders on June

4, 2013.3, 2014. We will hold the meeting at 10:00 a.m. Eastern Time at our world headquarters, 50 Old Webster Road, Oxford, Massachusetts.

A notice of the annual meeting, a proxy statement, proxy card and our

20122013 annual report to stockholders, which provide detailed information relating to our activities and operating performance, accompany this letter.

At this year’s meeting, you will be asked to elect

nineten directors to our board of directors for a term of one year,

to approve our executive compensation in an advisory vote and to ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for

2013.2014. Our board of directors recommends that you approve each of these proposals. I urge you to read the proxy statement for further details about the proposals.

Your vote is important to us and our business.Whether or not you plan to attend the annual meeting of stockholders, we encourage you to cast your vote by completing, signing and dating the enclosed proxy card and returning it promptly in the envelope provided. You may also vote your shares using the internet or the telephone by following the instructions provided on the enclosed proxy card. On behalf of the entire IPG Board of Directors, we look forward to seeing you at the meeting.

|

|

|

| Sincerely, |

|

|

Dr. Valentin P. Gapontsev

Chairman of the Board of Directors and

Chief Executive Officer |

IPG PHOTONICS CORPORATION

Oxford, Massachusetts 01540

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

We invite you to attend our annual meeting of stockholders which is being held as follows:

|

| | | | | | |

| | | | | | |

| | Date: | | | | Tuesday, June 4, 20133, 2014 |

| | Time: | | | | 10:00 a.m. Eastern Time |

| | Location: | | | | IPG Photonics Corporation Oxford, Massachusetts 01540 |

At the meeting, we will ask our stockholders to:

elect nineten directors named in the proxy to serve until our 20142015 annual meeting of stockholders;

approve our executive compensation in an advisory vote; and

ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for 2013.

2014.You may vote on these matters in person or by proxy. Whether or not you plan to attend the meeting, we ask that you promptlyvote your shares. Only stockholders of record at the close of business on April 10, 20137, 2014 may vote at the meeting. |

|

|

By order of the Board of Directors IPG PHOTONICS CORPORATION |

|

|

Senior Vice President, General Counsel and Secretary |

Important Notice Regarding the Availability of Proxy Materials

for the Annual Meeting

to be held on June

4, 2013:3, 2014:

The

Proxy Statementproxy statement and

2012 Annual Report2013 annual report to

Stockholdersstockholders

are available athttp://investor.ipgphotonics.com/annual-proxy.cfm

ANNUAL MEETING OF STOCKHOLDERS

GENERAL INFORMATION ABOUT THE MEETING

Our Board of Directors is soliciting proxies from our stockholders in connection with our annual meeting of stockholders to be held on Tuesday, June

4, 20133, 2014 and any and all adjournments thereof. No business can be conducted at the annual meeting unless a majority of all outstanding shares entitled to vote are either present in person or represented by proxy at the meeting. As far as we know, the only matters to be brought before the annual meeting are those referred to in this proxy statement. If any additional matters are presented at the annual meeting, the persons named as proxies may vote your shares in their discretion.

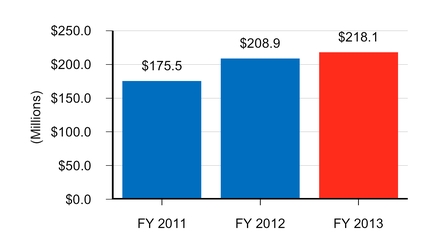

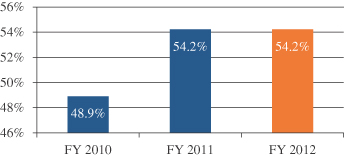

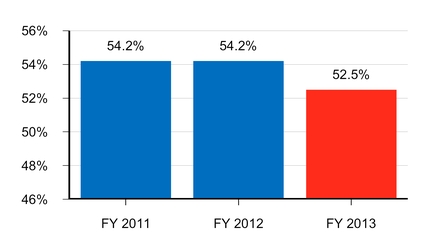

This proxy statement and our 20122013 annual report are first being mailed to stockholders of record on or about April 17, 2013,15, 2014, and are made available on our website athttp://investor.ipgphotonics.com/annual-proxy.cfm. Information on our website does not constitute part of this proxy statement. Unless otherwise noted, the information in this proxy statement covers

our 2013 fiscal year (or “fiscal 2013”), which ran from January 1, 2013 through December 31, 2013, and, in some cases, our 2012 fiscal year (or “fiscal 2012”), which ran from January 1, 2012 through December 31,

2012, and, in some cases, our 2011 fiscal year (or “fiscal 2011”), which ran from January 1, 2011 through December 31, 2011.2012.

Questions and Answers about the

Annual Meeting and Voting

When and Where Is the Annual Meeting? |

| | |

| When: | | Tuesday, June 4, 2013,3, 2014, at 10:00 a.m. Eastern Time |

| Where: | | IPG Photonics Corporation Oxford, Massachusetts 01540 |

Who Is Entitled to Vote at the Meeting?

You are entitled to vote at the meeting if you owned IPG Photonics shares (directly or in “street name,” as defined below) as of the close of business on April

10, 2013,7, 2014, the record date for the meeting. On that date,

51,435,29052,014,775 shares of our common stock were outstanding and entitled to vote and no shares of our preferred stock were outstanding. Each share of our common stock is entitled to one vote with respect to each matter on which it is entitled to vote; there is no cumulative voting with respect to any proposal.

What Do I Need to Do If I Plan to Attend the Meeting in Person?

If you plan to attend the annual meeting in person, you must provide proof of your ownership of our common stock and a form of personal identification, such as a driver’s license, for admission to the meeting. If you are a stockholder of record, the top half of your proxy card is your admission ticket and will serve as proof of ownership. If you hold your shares in street name, a recent brokerage statement or a letter from your bank or broker are examples of proof of ownership. If you hold your shares in street name and you also wish to be able to vote at the meeting, you must obtain a proxy, executed in your favor, from your bank or broker.

What Is the Difference Between Holding Shares Directly as a Stockholder of Record and Holding Shares in “Street Name” at a Bank or Broker?

Most of our stockholders hold their shares directly through a broker, bank or other nominee rather than directly in their own name. As summarized below, there are differences between shares held of record and those held in “street name.”

Stockholder of Record: If your shares are registered directly in your name with our transfer agent, Computershare, N.A., you are considered the stockholder of record with respect to those shares, and the proxy statement and annual report were sent directly to you. As the stockholder of record, you have the right to vote your shares as described herein. “Street Name” Stockholder: If your shares are held by a bank or broker as your nominee, you are considered the beneficial owner of shares held in “street name,” and the proxy statement and annual report were forwarded to you by your bank or broker who is considered the stockholder of record with respect to those shares. Your bank or broker sent to you, as the beneficial owner, a document describing the procedure for voting your shares. You should follow the instructions provided by your bank or broker to vote your shares. You are also invited to attend the annual meeting. However, if you wish to be able to vote at the meeting, you must obtain a proxy card, executed in your favor, from your bank or broker.

What Matters Am I Being Asked to Vote On at the Meeting and What Vote is Required to Approve Each Matter?

You are being asked to vote on

twothree proposals. Proposal 1 requests the election of directors. Each director will be elected by the vote of the plurality of the votes cast when a quorum is present. A “plurality of the votes cast” means that the

nineten persons receiving the greatest number of votes cast “for” will be elected. “Votes cast” excludes

abstentions"withhold votes" and any

broker non-votes (as defined below). Accordingly, withhold votes

withheld by brokers in the absence of instructions from street-name holders (“and broker

non-votes”).non-votes will have no effect on Proposal 1. If you hold your shares in street name, it is critically important that you submit your voting instructions to your bank or broker if you want your shares to count for Proposal 1.

Proposal 2 requests the approval of our executive compensation. It is an advisory vote which means that it is not binding upon the Company.

Proposal 3 requests the ratification of the appointment of our independent registered public accounting firm.

The affirmative vote of a majority of the shares which are present at the meeting in person or by proxy, and entitled to vote thereon, is required for

such ratification.approval of Proposals 2 and 3. Abstentions have the same effect as voting against

Proposals 2 and 3. Broker non-votes have no effect on Proposal 2.

We have engaged Computershare

N.A. as our independent agent to receive and tabulate stockholder votes. Computershare will separately tabulate “for,” “against” and “withhold” votes, abstentions and broker non-votes. Computershare will also act as independent election inspector to certify the results, determine the existence of a quorum and the validity of proxies and ballots, and perform any other acts required under the General Corporation Law of Delaware.

Most stockholders have a choice of voting in one of four ways:

using a toll-free telephone number;

completing a proxy/voting instruction card and mailing it in the postage-paid envelope provided; or

in person at the meeting.

The telephone and Internet voting facilities for stockholders of record will close at 1:00 a.m. Central Time on June

4, 2013.3, 2014. The Internet and telephone voting procedures are designed to authenticate stockholders by use of a control number and to allow you to confirm that your instructions have been properly recorded.

If you hold your shares in street name, your bank or broker will send you a separate package describing the procedures and options for voting your shares. Please read this information carefully.

What Does it Mean to Give a Proxy?

Your properly completed proxy/voting instruction card will appoint Valentin P. Gapontsev and Angelo P. Lopresti as proxy holders or your representatives to vote your shares in the manner directed therein by you. Dr. Gapontsev is our Chairman of the Board and Chief Executive Officer. Mr. Lopresti is our Senior Vice President, General Counsel and Secretary. Your proxy permits you to direct the proxy holders to vote “for” or “withhold” for the nominees for director (Proposal 1), and “for”, “against”,“for,” “against,” or “abstain” from the advisory vote on executive

compensation (Proposal 2) and the ratification of the appointment of our independent registered accounting firm (Proposal

2)3).

All of your shares entitled to vote and represented by

a properly completed proxy or voting instruction received prior to the meeting and not revoked will be voted at the meeting in accordance with your

instructions.instruction.

What Happens If I Sign, Date and Return My Proxy But Do Not Specify How I Want My Shares Voted on One of the Proposals?

Stockholder of Record: Your proxy will be counted as a vote “For” all of the nominees for director and “For” Proposal 2.Proposals 2 and 3. “Street Name” Stockholder: Your bank, broker or nominee may vote your shares only on those proposals on which it has discretion to vote. Under New York Stock Exchange rules, your bank, broker or nominee does not have discretion to vote your shares on non-routine matters such as the election of directors (Proposal 1) and the advisory vote on executive compensation (Proposal 2). This is called a "broker non-vote." However, your bank, broker or nominee does have discretion to vote your shares on routine matters such as the ratification of the appointment of our independent registered public accounting firm (Proposal 3). Accordingly, if you do not give your bank, broker or nominee specific instructions with respect to Proposal 2.3, your shares will be voted in such entity’s discretion. We urge you to promptly provide your bank, broker or nominee with appropriate voting instructions so that all of your shares may be voted at the meeting.

Can I Change My Vote Before the Meeting?

You can change your vote at any time before your proxy is exercised by delivering a properly executed, later-dated proxy (including an Internet or telephone vote), by revoking your proxy by written notice to the Secretary of IPG Photonics, or by voting in person at the meeting. The method by which you vote by a proxy will in no way limit your right to vote at the meeting if you decide to attend in person.

If your shares are held in street name, please refer to the information forwarded by your bank,

broker or

brokernominee for procedures on changing your voting instructions.

Is the Proxy Statement Available on the Internet?

Yes. We are mailing copies of the proxy statement and our 20122013 annual report to all stockholders. Stockholders can also view these documents on the Internet by accessing our website athttp://investor.ipgphotonics.com/annual-proxy.cfm.annual-proxy.cfm.

Who Is Soliciting my Proxy and Who is Paying for the Cost of this Proxy Solicitation?

The Board of Directors of IPG Photonics is soliciting your proxy to vote at the

20132014 annual meeting of stockholders. IPG Photonics will bear the expense of preparing, printing and mailing this proxy material, as well as the cost of any required solicitation. Our directors, officers or employees may solicit proxies on our behalf. We have not engaged a proxy solicitation firm to assist us in the solicitation of proxies, but we may if we deem it appropriate. In addition, we will reimburse banks, brokers and other custodians, nominees and fiduciaries for reasonable expenses incurred in forwarding proxy materials to beneficial owners of our stock and obtaining their proxies.

What Is the Quorum Required to Transact Business?

At the close of business on April

10, 2013,7, 2014, the record date, there were

51,435,29052,014,775 shares of our common stock outstanding. Our by-laws require that a majority of our common stock be represented, in person or by proxy, at the meeting in order to constitute the quorum we need to transact business at the meeting. We will count

withhold votes, abstentions and broker non-votes in determining whether a quorum exists.

At IPG Photonics, we believe that strong and effective corporate governance procedures and practices are an extremely important part of our corporate culture. We have summarized several of our corporate governance practices below.

Significant Corporate Governance Practices and Policies

Listed below are some of the significant corporate governance practices and policies we have adopted:

| • | | Independent Director Majority and Presiding Independent Director. Seven of the ten directors currently on our Board of Directors (the “Board”) are non-employees of the Company who meet the independence criteria under applicable SEC rules and NASDAQ guidelines. Only independent directors sit on our three standing Board committees. The Board established the role of a presiding independent director who is elected annually by the independent directors. More information about the role of the independent directors, the presiding independent director and our Board structure can be found below in this section.

|

| • | | Executive Sessions. Our Board meets regularly in executive sessions without the presence of management, including our Chairman. These sessions are led by our presiding independent director, as described further below in this section.

|

| • | | Annual Election of Entire Board. Stockholders elect each director annually. We do not have a classified board.

|

| • | | Related Person Transaction Policy. Our Nominating and Corporate Governance Committee is responsible for approving or ratifying transactions involving our Company and related persons and determining if the transaction is in, or not inconsistent with, the best interests of our Company and our stockholders. More information about our Related Person Transaction Policy and transactions can be found below in this section.

|

| • | | Stock Ownership Guidelines. Our directors and executive officers are required to own a minimum amount of IPG Photonics shares. We believe that stock ownership requirements align the interest of the directors and officers with stockholders. Our directors and executive officers fully complied with our guidelines in 2012.

|

| • | | Prohibition on Hedging. Our Insider Trading Policy expressly prohibits directors and employees from engaging in short sales of our common stock or buying or selling puts, calls or derivative securities in connection with IPG Photonics shares.

|

Independent Director Majority and Presiding Independent Director. Six of the nine directors currently on our Board of Directors (the “Board”) are non-employees of the Company who meet the independence criteria under applicable rules of the Securities and Exchange Commission ("SEC") and NASDAQ guidelines. Only independent directors sit on our three standing Board committees. Several years ago, the Board established the role of a presiding independent director who is elected annually by the independent directors. More information about the role of the independent directors, the Presiding Independent Director and our Board structure can be found below in this section.

Executive Sessions. Our Board meets regularly in executive sessions without the presence of management, including our Chairman. These sessions are led by our Presiding Independent Director, as described below in this section.

Annual Election of Entire Board. Stockholders elect each director annually. We do not have a classified board.

Related Person Transaction Policy. Our Nominating and Corporate Governance Committee is responsible for approving or ratifying transactions involving our Company and related persons and determining if the transaction is in, or not inconsistent with, the best interests of our Company and our stockholders. More information about our Related Person Transaction Policy and transactions can be found below in this section.

Stock Ownership Guidelines. Our directors and executive officers are required to own a minimum amount of IPG Photonics shares. We believe that stock ownership requirements align the interest of the directors and officers with our stockholders. Our directors and executive officers fully complied with our guidelines in 2013. In 2013, our Board increased the stock ownership requirements for our directors.

Prohibition on Hedging; Limits on Pledging. Our Insider Trading Policy expressly prohibits directors and employees from engaging in short sales of our common stock or buying or selling puts, calls or derivative securities in connection with IPG Photonics shares. In 2013, the Board adopted a policy to limit the pledging of our stock by directors and officers.

Additional information is provided below regarding these and certain other key corporate governance policies, which we believe enable us to manage our business in accordance with high standards of business practices and in the best interest of our stockholders. Many policies may be found athttp://investor.ipgphotonics.com/governance.cfm. Note that information on our website does not constitute part of this proxy statement. Hard copies of these documents may be obtained without charge by any stockholder upon request by contacting the Office of the Secretary, IPG Photonics Corporation, 50 Old Webster Road, Oxford, Massachusetts 01540. Corporate Governance Guidelines

Our Board has adopted Corporate Governance Guidelines that outline, among other matters, the

roleroles and functions of the Board, the responsibilities of various Board committees and the mission of the Board. Each of the Board committees has a written charter that sets forth the purposes, goals and responsibilities of the committee as well as qualification for committee membership, procedures for committee membership, appointment and removal, committee structure and operations and committee reporting to the

full board.entire Board.

The Governance Guidelines provide, among other things, that:

a majority of our Board must be independent;

the presiding independent directorPresiding Independent Director presides over executive sessions of independent directors;

the Board appoints all members and chairpersons of the Board committees;

the Audit, Compensation, and Nominating and Corporate Governance Committees consist solely of independent directors;

the independent directors meet periodically in executive sessions without the presence of the non-independent directors or members of our management;

directors may not serve on the boards of more than three other public companies;

evaluations of the Board and committees are to be conducted annually; and

directors may not serve on the boards of more than three other public companies;

the Board and key officers should have a meaningful financial stake in the Company.

The Board

regularly reviews changing legal and regulatory requirements, evolving best practices and other developments. The Board modifies the Governance Guidelines and its other corporate governance policies and practices from time to time, as appropriate.

Executive Sessions. Our independent directors meet privately, without employee directors or management present, at least four times during the year. These private sessions are generally held in conjunction with the regular quarterly Board meetings. Other private meetings are held as often as deemed necessary by the independent directors. The Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee meet without employee directors or management present from time to time as they deem necessary. Director Meetings and Policy Regarding Board Attendance. It has been the practice of our Board and its committees to hold at least four in-person regular meetings each year. The Board and its committees also have telephone meetings throughout the year. In accordance with our Governance Guidelines, our directors are expected to prepare for, attend and actively participate in meetings of the Board and its committees. Our directors are expected to spend the time needed at each meeting and to meet as frequently as necessary to properly discharge their responsibilities. We encourage members of our Board to attend annual meetings of stockholders, but we do not have a formal policy requiring them to do so. Stock Ownership Guidelines. The Board adopted stock ownership guidelines to more closely align the interests of our directors and executive officers with those of our long-term stockholders. Under the guidelines, the following persons are expected to maintain a minimum investment in our common stock as follows: for non-employee directors, the lesser of 3,000 shares or onethree times their annual cash Board retainer (excluding committee retainers); for the Chief Executive Officer, the lesser of 7,500 shares or one times his annual salary; and for other executive officers, the lesser of 5,000 shares or one times their respective annual salaries. In 2013, the Board approved an increase in stock ownership requirements for non-employee directors to the level stated in the previous sentence. Vested equity compensation such as vested stock options and restricted stock, counts towards the stock ownership levels. Indirect ownership of shares through aseparate legal entity counts toward fulfillment of the ownership guidelines. These ownership levels are to be achieved no later than four years after the election as a director or as an executive officer, except that prior to such time the director or officer is expected to retain a certain portion of stock issued upon exercise of stock options or issuancevesting of restricted stock under equity compensation plans after payment of the exercise price and taxesawards until the minimum ownership levels are attained. All directors and all executive officers were in compliance with our stock ownership guidelines as of December 31, 2012.

2013.

Board Self-Assessments. The Board conducts annual self-evaluations to determine whether it and its committees are functioning effectively. The Nominating and Corporate Governance Committee oversees the Board and committee self-assessments and the Board receives a report on its self-assessments annually. Each committee reviews and reassesses the adequacy of its charter annually and recommends any proposed changes. Each committee also annually reviews its own performance and reports the results to the Board. Prohibition on Hedging.Hedging; Limits on Pledging. Under our Insider Trading Policy, no director or employee may engage in shorting shares of our common stock, or buying or selling puts, calls or derivatives related to our common stock. In addition, the Board approved in 2013 limits on pledging. A director or officer of the Company may not pledge shares constituting more than 20% of his or her total stock ownership. Pledges of shares constituting 20% or less of total stock ownership are subject to certain conditions. Director Orientation and Continuing Education. Upon joining the Board, directors are provided with an initial orientation about our management, including our business operations, strategy and governance. New directors without previous experience as a director of a public company are expected to enroll in a director education program on the principles of corporate governance and director professionalism offered by a nationally-recognized sponsoring organization. We also provide orientation to directors who join a committee, including oversight responsibilities, policies and practices. We provide our directors with resources and ongoing educational

opportunities to assist them in remaining abreast of developments in corporate governance and critical issues relating to the operation of public company boards.

We pay for director education expenses and their membership inAll current directors are enrolled members of the National Association of Corporate

Directors.Directors and we plan to enroll newly elected directors as well. We pay for membership dues and director education expenses. The Board also conducts periodic visits to

major facilities of the Company

facilities as part of its regularly scheduled Board meetings.

Nomination of Directors. The Nominating and Corporate Governance Committee considers candidates for director nominees proposed by directors and stockholders. This Committee may retain recruiting professionals and use director databases to assist in identifying and evaluating candidates for director nominees. The Board seeks members from diverse professional backgrounds with a reputation for integrity who do not have professional commitments that might unreasonably interfere with the demands and duties of a board member. Candidates for director are reviewed in the context of the current composition of the Board, the operating requirements of the Company and the long-term interests of the Company’s stockholders. The Nominating and Governance Committee seeks directors with a broad spectrum of experience and expertise. It seeks a Board that reflects diversity, including in the membership of the Board.experience, gender and ethnicity. It does not have formal objective criteria for determining the degree of diversity needed or present on the Board. Instead, it and the Board seek candidates with a range of experience. Board candidates are considered based upon various criteria, such as age, skills, knowledge,demonstrated excellence, leadership and significant experience in an area of endeavor, relevant expertise and experience and the ability to offer advice and guidance based upon that expertise, possession of high personal integrity and ethics, ability to read and understand financial statements, a commitment to representing the long-term interests of the Company's stockholders while keeping in perspective broad business judgmentthe interests of customers, suppliers and leadership, knowledge of relevant industry, technical or regulatory affairs, business creativity and vision, experienceemployees, and any other factors appropriate in the context of an assessment by the Nominating and Corporate Governance Committee of the needs of the Board at that time. Candidates for director should also have certain minimum qualifications, including the ability to read and understand basic financial statements, and must be over 21 years of age and possess the highest personal integrity and ethics. In addition, the Nominating and Corporate Governance Committee considers whether the individual satisfies criteria for independence as may be required by applicable regulations. The Nominating and Corporate Governance Committee retained the search firm Heidrick & Struggles to assist in the search and evaluation of candidates for director which resulted in the appointmentnomination of Mr. Eric Meurice and Mr. Thomas Seifert for election to the Board at our 2014 annual meeting. See "Board of Mr. Peeler in September 2012.Directors -- Nominees for Directors" below.

The Nominating and Corporate Governance Committee has adopted a policy under which it will consider nominations by stockholders. The same identifying and evaluating procedures apply to all

candidates for director nomination, including candidates submitted by stockholders. The Nominating and Corporate Governance Committee evaluates and interviews potential board candidates. All members of the Board may interview the final candidates.

Code of Business Conduct. We have a code of business conduct that applies to all of our directors and employees, including our Chief Executive Officer, Chief Financial Officer and other executive officers. Our code of business conduct includes provisions covering conflicts of interest, business gifts and entertainment, outside activities, compliance with laws and regulations, insider trading practices, antitrust laws, payments to government personnel, bribes or kickbacks, corporate record keeping and accounting records. The code of business conduct is posted on our website atwww.ipgphotonics.com. http://investor.ipgphotonics.com/governance.cfm. Procedures for Submitting Complaints Regarding Accounting and Auditing Matters. We have procedures for the treatment of complaints regarding accounting, internal accounting controls, auditing matters, fight against bribery, banking, and financial crime, including procedures for the confidential and anonymous submission by our directors, officers and employees of concerns regarding questionable accounting, internal accounting controls or auditing matters. These procedures are posted on our website atwww.ipgphotonics.com. http://investor.ipgphotonics.com/governance.cfm.Director Independence

We follow director independence rules under NASDAQ listing standards and SEC rules. Our Nominating and Corporate Governance Committee has determined that seven of

Board Leadership Structure

Dr. Gapontsev, our

ten director nominees, Messrs. Blair, Child, Gauthier, Hurley, Kampfe, Krupke and Peeler are “independent”Chief Executive Officer, also serves as

defined by NASDAQ Rule 4200(a)(15). Our Nominating and Corporate Governance Committee has determined that no such member has a relationship that would interfere with the

exercise of independent judgment in carrying out his responsibilities as a director.EachChairman of the following committees of the BoardBoard. Our independent directors determined several years ago that, for effective board governance, it is composed solely of independent directors:

the Compensation Committee; and

the Nominating and Corporate Governance Committee.

Board Leadership Structure

In accordance with our Governance Guidelines, the Board has appointedimportant to have a presiding independent director with leadership authority and responsibilities. The presiding independent director setsdirector. Mr. Gauthier has been selected as the agendaPresiding Independent Director for and leads, executive sessions of the independent directors, providing consolidated feedback, as appropriate, from those meetings to the Chairman and Chief Executive Officer. The presiding independent director provides input on the agenda for board meetings; facilitates discussions outside of scheduled board meetings among the independent directors on key issues as required; and serves as a non-exclusive liaison with the Chairman andterm ending June 2014.

Dr. Gapontsev became our Chief Executive Officer

and Chairman in

consultation with the other independent directors. The independent directors of our Board elected Mr. Gauthier as presiding independent director, and this position is voted upon annually by our independent directors.Dr. Gapontsev serves as our Chairman and Chief Executive Officer. He is the founder of the Company and beneficially owns approximately 15.6% of the Company’s common stock as of April 1, 2013.2000. His dual role was established twelvefourteen years ago when the Board was first established. Our directors believe that each of the possible leadership structures for a board has its particular pros and cons which much be considered in the context of the specific

circumstances, culture and challenges facing a company, and that such consideration is the responsibility of a company’s board that has a diversity of views and experiences. Our directors come from a variety of organizational backgrounds and have direct experience with a wide range of leadership and management structures. The makeup of our Board puts it in a very strong position to evaluate the pros and cons of the various types of board leadership structures and to ultimately decide which structure is in the best interests of our stockholders.The independent directors believe that having Dr. Gapontsev serve in both capacities is in the best interest of the Company and its stockholders because it allows Dr. Gapontsev to more effectively execute the Company’s strategic initiatives and business plans. He is the founder of the Company and beneficially owns approximately 15.0% of the Company’s common stock. The combination of the roles of Chairman and Chief Executive Officer in Dr. Gapontsev creates clear and unambiguous authority, which is essential to effective management. The Board and management can respond more effectively to a clear line of authority. Further, given that he is closer to the Company’s business than any other Board member and he has the benefit of over 14 years of operations and leadership experience within the Company, Dr. Gapontsev is best-positioned to set the Board’s agenda and provide leadership. Dr. Gapontsev's extensive scientific and business experience also gives him vast industry knowledge, which the Board believes is critical for the chairman of the board of a company that operates in a highly technical industry. The combined Chairman/Chief Executive structure is a leadership model that has served our stockholders well for many years.

The Board also recognized the importance for a board to have in place, and build upon, a counterbalancing structure to ensure that it functions in an appropriately independent manner. As a result, the Board enhanced its governance structure several years ago by creating the position of Presiding Independent Director with leadership authority and responsibilities. The duties and responsibilities of the Presiding Independent Director include: setting the agenda for, and leading, executive sessions of the independent directors; providing consolidated feedback from those meetings to the Chairman and Chief Executive Officer; providing input on the agenda for Board meetings; periodically providing feedback on the quality and quantity of information flow from management; having the the authority to call meetings of the independent directors; facilitating discussions outside of scheduled Board meetings among the independent directors on key issues as required; serving as a non-exclusive liaison with the Chairman and Chief Executive Officer in consultation with the other independent directors; interviewing Board candidates as appropriate; and, commencing in 2014, leading the determination of the goals and objectives for the Chairman and Chief Executive Officer with the input of the independent directors and the annual performance evaluation for him with the input of the independent directors and providing that evaluation to the Compensation Committee. In the event of a crisis, the Presiding Independent Director would have an increased role in crisis management oversight. The independent directors of our Board elected Mr. Gauthier as the Presiding Independent Director for the term ending June 2014, and this position is voted upon annually by our independent directors.

The Board believes that the

appointmentposition and responsibilities of a presiding independent director and the regular use of executive sessions of the

non-managementindependent directors

without the Chief Executive Officer or other executive officers present, along with the Company’s strong committee system and substantial majority of independent directors, allow

itthe Board to maintain effective oversight.

One of the Board’s primary roles in the Company is to provide general oversight of strategy and operations. The Board reviews strategy regularly with management and provides input to management. As part of its oversight of operations, the entire Board reviews and discusses the performance of the Company and the principal risks involved in the operations and management of the Company. The Board allocates risk oversight responsibility among the full Board, the independent directors and the three

committees.standing committees of the Board. The Nominating and Corporate Governance Committee periodically reviews risk oversight matters and responsibilities, then makes recommendations to the Board to allocate risk oversight responsibilities.

The Board as a whole reviews risk management practices and a number of significant risks in the course of its reviews of corporate strategy, management reports and other presentations. The independent directors as a group oversee succession and resource planning. The Audit Committee oversees certain financial risks and recommends guidelines to monitor and control such risk exposures. The Compensation Committee reviews the Company’s executive compensation programs, their effectiveness at both linking executive pay to performance and aligning the interests of our executives and our stockholders, and oversees an entity-wide compensation risk assessment. The Nominating and Corporate Governance Committee reviews significant related party transactions with directors, executives and managers and may conduct negotiations on behalf of the Company. The Board’s risk oversight role does not interfere with the Company’s day-to-day management because over two-thirds of the current directors and over

two-thirds of the director nominees are independent

directors and therefore have no conflicts that might discourage critical review of the Company’s risks.

RELATED PERSON TRANSACTIONS

The Board adopted a related person transaction policy that requires the Company’s executive officers, directors and nominees for director to promptly notify the Corporate Secretary in writing of any transaction in which (i) the amount exceeds $100,000, (ii) the Company is, was or is proposed to be a participant and (iii) such person or such person’s immediate family members (“Related Persons”) has, had or may have a direct or indirect material interest (a “Related Person Transaction”). Subject to certain exceptions in the policy, Related Person Transactions must be brought to the attention of the Nominating and Corporate Governance Committee for an assessment of whether the transaction or proposed transaction should be

permitted to proceed.permitted. In deciding whether to approve or ratify the Related Person Transaction, the Nominating and Corporate Governance Committee considers relevant facts and circumstances. If the Nominating and Corporate Governance Committee determines that

thea Related Person has a direct or indirect material interest in any such transaction, the Committee must review and approve, ratify or disapprove the Related Person Transaction.

Pursuant to our Governance Guidelines, we expect each of our directors to ensure that other existing and future commitments do not conflict with or materially interfere with his or her service as a director. Directors are expected to avoid any action, position or interest that conflicts with our interests or gives the appearance of a conflict. In addition, directors are required to inform the chairman of our Nominating and Corporate Governance Committee prior to joining the Board of another public company to ensure that any potential conflicts, excessive time demands or other issues are carefully considered.

In

2012,2013, the Company purchased from Veeco Instruments Inc.

of equipment and services amounting to approximately

$3,973,000.$1,155,000. Mr. Peeler,

appointed to thea non-employee member of our Board,

in September 2012, is the Chief Executive Officer and Chairman of the Board of Veeco Instruments Inc.

Veeco Instruments, Inc. was a provider of equipment and services to the Company for several years before Mr. Peeler was elected to the Board. The Nominating and Corporate Governance reviewed and approved the transactions with Veeco Instruments Inc., which were ordinary course of business transactions conducted on an “arm’s length” basis with the Company.

As noted page 36 of this Proxy Statement, Dr. Gapontsev is encouraged to use Company provided aircraft for security and other reasons. When using Company provided aircraft for personal travel, Dr. Gapontsev is required to reimburse the Company for all hours, additional fees and incremental costs related to his personal use or others traveling with him under the corporate aircraft policy approved by the Compensation Committee. In accordance with this policy, Dr. Gapontsev reimbursed the Company $268,839 for the full cost of such travel in 2012.

Communication with our Board of Directors

Interested parties wishing to write to the Board or a specified director or a committee of the Board should send correspondence to

the Office of the Secretary, IPG Photonics Corporation, 50 Old Webster Road, Oxford, Massachusetts 01540. All written communications received in such manner from stockholders of the Company will be forwarded to the members or committee of the Board to whom the communication is directed or, if the communication is not directed to any particular member(s) or committee(s) of the Board, the communication shall be forwarded to all members of the Board.

BOARD OF DIRECTORS

Mr. Michael Kampfe

Dr. William Krupke decided to not stand for re-election to our Board of Directors at our

20132014 annual meeting. IPG Photonics extends its sincere appreciation to

Mr. KampfeDr. Krupke for the valuable contributions he provided to our Company

and stockholders during his service

to IPG as a member of our Board

of Directors. The Nominating and Corporate Governance Committee requested that Dr. Krupke continue to serve on the Board based upon his ongoing contributions to the Board and his technical knowledge of lasers and the laser industry. Dr. Krupke, who previously informed the Board of his decision to retire from the Board of Directors at the completion of the current term, agreed to stand for reelection at the 2013 annual meeting of stockholders.The Company’s Certificate of Incorporation provides that the size of the Board may be from one to eleven directors. since 2000.

The Board

is currently

has set the number of directors at nine. The number of directors will be set at ten

members. However,directors from and after the

size of the Board will be reduced to nine members effective June 4, 2013, the date of our 20132014 annual

meeting of stockholders.meeting.

The following table sets forth certain information as of April 1,

20132014 regarding

our incumbent directors nominated for re-election.the director nominees. Each of our incumbent directors, other than

Mr. KampfeDr. Krupke (who decided to not stand for re-election), has been nominated by the Board for election at our

20132014 annual

meeting.meeting and there are two director nominees who are not currently directors, Messrs. Meurice and Seifert.

| |

| | | | |

| Name | | Age | | | Position |

Valentin P. Gapontsev, Ph.D. | | | 74 | 75 | | Chief Executive Officer and Chairman of the Board |

Eugene Scherbakov, Ph.D. | | | 65 | 66 | | Managing Director of IPG Laser GmbH, Senior Vice President, Europe and Director |

Igor Samartsev | | | 50 | 51 | | Chief Technology Officer and Director |

Robert A. Blair | | | 66 | 67 | | Director |

Michael C. Child | | | 58 | 59 | | Director |

Henry E. Gauthier | | | 72 | 73 | | Director |

William S. Hurley | | | 68 | 69 | | Director |

William F. Krupke, Ph.D.

Eric Meurice | | | 7657 | | Nominee for Director |

| John R. Peeler | | 59 | | Director |

John R. Peeler

Thomas J. Seifert | | | 5850 | | | Nominee for Director |

Valentin P. Gapontsev, Ph.D., founded IPG in 1990 and has been our Chief Executive Officer and Chairman of our Board since our inception. Prior to that time, he served as senior scientist in laser material physics and head of the laboratory at the Soviet Academy of Science’s Institute of Radio Engineering and Electronics in Moscow. He has over thirty years of academic research experience in the fields of solid state laser materials, laser spectroscopy and non-radiative energy transfer between rare earth ions and is the author of many scientific publications and several international patents. Dr. Gapontsev holds a Ph.D. in Physics from the Moscow Institute of Physics and Technology. In 2006, he was awarded the Ernst & Young® Entrepreneur of the Year Award for Industrial Products and Services in New England, and in 2009, he was awarded the Arthur L. Schawlow Award by the Laser Institute of America. In 2011, he received the Russian Federation National Award in Science and Technology, and he was also selected as a Fellow of the Optical Society of America.He is the founder of the Company and has successfully led the Company and the Board since the Company was formed. His scientific understanding along with his corporate vision and operational knowledge provide strategic guidance to the Company and the Board. For these reasons, he has been nominated to continue serving on the Board. Eugene Scherbakov, Ph.D., has served as the Managing Director of IPG Laser GmbH, our German subsidiary, since August 2000 and has been a member of our Board since September 2000. He has served as Senior Vice President-Europe since February 2013. Dr. Scherbakov served as the Technical Director of IPG Laser from 1995 to August 2000. From 1983 to 1995, Dr. Scherbakov was a senior scientist in fiber optics and head of the optical communications laboratory at the General Physics Institute, Russian Academy of Science in Moscow. Dr. Scherbakov graduated from the Moscow Physics and Technology Institute with an M.S. in Physics. In addition, Dr. Scherbakov attended the Russian Academy of Science in Moscow, where he received a Ph.D. in Quantum Electronics from its Lebedev Physics Institute and a Dr.Sci. degree in Laser Physics from its General Physics Institute. Dr. Scherbakov has been nominated to continue serving on the Board because of his position as manager of IPG Laser GmbH and because of his extensive technological knowledge of fiber lasers and components and the manufacturing process. His service as an executive officer of the Company provides the Board with a detailed understanding of the Company’s operations. Igor Samartsev has served as our Chief Technology Officer since 2011 and has been a member of our Board since February 2006. Since 2005, he has also served as the Deputy General Manager of our Russian subsidiary, NTO IRE-Polus. He served as the Technical Director of NTO IRE-Polus from 2000 to April 2005 and, from 1993 to 2001, he was the Deputy Director of NTO IRE-Polus. Mr. Samartsev holds an M.S. in Physics from the Moscow Institute of Physics and Technology.Mr. Samartsev is one of the founders of the Company and has a significant management role in the Company as Chief Technology Officer and as Deputy General Manager of our Russian subsidiary.Officer. The Board values Mr. Samartsev’s understanding of technology developments at the Company as well as our Russian operations.Company. For these reasons, he has been nominated to continue serving on the Board. Robert A. Blair has served as a member of our Board since September 2000. Since January 1999, Mr. Blair has been the President of the Blair Law Firm P.C. Mr. Blair was a senior partner at the law firm of Manatt, Phelps &

Phillips from 1995 to 1999. He was the managing partner of the law firm of Anderson, Hibey, Nauheim & Blair from 1981 to 1995. He was an independent trustee under Winkler Trusts from 1996 to 2012, previously the primary sources of equity for, and owners of, real estate ventures developed by The Mark Winkler Company.Company from 1996 to 2012. Mr. Blair is managing partner of several real estate partnerships, has been a manager/principal in cellular telephone ventures and assisted in the launch of a VoIP business. He is the founding Chairman and Chairman Emeritus of the S Corporation Association of America. Mr. Blair holds a B.A. in Mathematics from the College of William & Mary, where he previously served on its governing Board of Visitors, and a J.D. from the University of Virginia School of Law, where he was a member of the Virginia Law Review.Mr. Blair has been nominated to continue serving on the Board because of his extensive management and legal experience and his knowledge of internationalbusiness transactions and government practice. Also, Mr. Blair has valuable experience from years of serving on compensation committees and negotiating numerous employment arrangements.

Michael C. Child has served as a member of our Board since September 2000. Since July 1982, Mr. Child has been employed by TA Associates, Inc., a private equity investment firm, where he currently serves as Senior Advisor and prior to January 2011, was Managing Director. Since June 2010, he has served on the board of directors of Finisar Corporation, a developer and manufacturer of optical subsystems and components for networks. He also has served on the board of directors of Ultratech Inc. since April 2012. Ultratech is a developer and manufacturer of advanced packaging lithography systems and laser processing technologies. Mr. Child holds a B.S. in Electrical Engineering from the University of California at Davis and an M.B.A. from the Stanford University Graduate School of Business. Mr. Child has been nominated to continue serving on the Board because of his extensive knowledge of management, operations and finance of technology growth companies. In addition, he has extensive board and committee experience at both public and private companies. Henry E. Gauthier has served as a member of our Board since April 2006. Mr. Gauthier was President from February 2005 to May 2005, consultant from January 2004 to February 2005 and June 2005 to December 2006, and Chairman of the board of directors from May 2005 to December 2008, of Reliant Technologies, Inc., which was acquired in December 2008 by Solta Medical, Inc., a manufacturer of medical laser systems and one of our customers.systems. He served as Vice Chairman of the board of directors of Coherent, Inc., a manufacturer of photonic products, from October 2002 to March 2006. He served as Chairman of the board of directors of Coherent, Inc. from February 1997 to October 2002 and was its President from 1983 to 1996. Since July 1996, Mr. Gauthier has served as a principal at Gauthier Consulting. He was a member of the board of directors of Alara, Inc. from 1997 to 2010. Mr. Gauthier attended the United States Coast Guard Academy, San Jose State University, and the Executive Institute of the Stanford University Graduate Business School.Mr. Gauthier has been nominated to continue serving on the Board because of his extensive knowledge of the laser industry and his management and operational experience from over two decades as an executive at the world’s largest publicly held laser company. Having been a member of the audit, compensation, and nominating and corporate governance committees of public and private company boards in the technology field, Mr. Gauthier is familiar with a full range of corporate and board functions. William S. Hurley has served as a member of our Board since April 2006. Since April 2006, he has been principal of W. S.W.S. Hurley Financial Consulting, which provides supplemental chief financial officer services. From 2002 to April 2006, he was a partner with Tatum LLC, a nationwide executive services and consulting firm. He was Senior Vice President and Chief Financial Officer at Applied Science & Technology Inc., a developer, manufacturer and supporter of semiconductor capital equipment, from 1999 until 2001. He served as Vice President and Chief Financial Officer at Cybex International, Inc., a designer, manufacturer and distributor of fitness equipment, from 1996 to 1999. From 1992 to 1995, he was Vice President-Controller and Chief Accounting Officer at BBN Corporation, formerly known as Bolt, Beranek & Newman, Inc., a high technology company. From 1993 to 2004, Mr. Hurley was a member of the board of directors of The L. S.L.S. Starrett Company, a manufacturer of precision tooling, where he served on the audit and compensation committees. He holds a B.S. in Accounting from Boston College and an M.B.A. in Finance from the Columbia University Graduate School of Business, is a certified public accountant, and possesses a Certificate of Director Education issued by the National Association of Corporate Directors. Mr. Hurley has been nominated to continue serving on the Board because of the extensive experience he gained during his service on the board of directors of The L. S.L.S. Starrett Company and his experience as a chief financial officer of two public companies. William F. Krupke, Ph.D.Eric Meurice, has a nominee for director, served as President and Chief Executive Officer of ASML Holding NV, a memberprovider of our Boardsemiconductor manufacturing equipment and technology, from October 2004 to June 2013, and as Chairman until March 2014. From 2001 to 2004, he was Executive Vice President of the Thomson Television Division of Thomson, SA, an electronics manufacturer. From 1995 to 2001, he served as head of Dell Computer's Western, Eastern Europe and EMEA emerging market businesses. Before 1995, he gained significant technology experience at ITT Semiconductors and at Intel Corporation. Mr. Meurice served on the boards of Verigy Ltd. (a

manufacturer of semiconductor test equipment), until its acquisition by Advantest Corporation in 2011, ARM Holdings plc (a semiconductor intellectual property supplier) from July 2013 to March 2014 and NXP Semiconductors N.V. (a semiconductor company) since February 2001. Since 1999, Dr. Krupke has been president ofApril 2014. Mr. Meurice earned a laser technologyMaster's degree in mechanics and applications consulting firm (now WFK Lasers, LLC). From 1972 to 1999, Dr. Krupke workedenergy generation at the Lawrence Livermore National Laboratory,which provides research and development services to various U.S. government departments, serving for the last twenty of such years as Deputy Associate Director of the Laser Programs Directorate. Dr. Krupke holdsEcole Centrale de Paris, a B.S.Master's degree in PhysicsEconomics from Rensselaer Polytechnic Institutela Sorbonne University, Paris, and M.A. and Ph.D. degrees in Physicsan M.B.A. from the Stanford University Graduate School of California at Los Angeles.Dr. KrupkeBusiness. Mr. Meurice has been nominated tocontinue serving serve on the Board because of his deep technological knowledgeskills and experience as a manager of lasers from over four decades of experiencerapidly-growing, complex and global businesses in the capital equipment and electronics fields with several billions of solid-state lasers and innovative laser materials. This provides the Board with valuable insight regarding the Company’s products and current technology,dollars in revenues. He has experience managing a publicly held company as well as experience on serving on public company boards. Mr. Meurice also has a record of proven leadership as a strategic thinker, operator and marketer at the future technological needs of the Company and the laser industry.businesses he managed.

John R. Peeler has served as a member or our Board since September 2012. He has been Chief Executive Officer and a director of Veeco Instruments Inc. since July 2007. Veeco is a developer and manufacturer of MOCVD, molecular beam epitaxy, ion beam and other advanced thin film processes. Prior thereto, heHe was Executive Vice President of JDS Uniphase Corp. (“JDSU”) and President of the Communications Test & Measurement Group of JDSU, which he joined upon the closing of JDSU’s merger with Acterna, Inc. (“Acterna”) in August 2005. Before joining JDSU, Mr. Peeler served as President and Chief Executive Officer of Acterna. He has a B.S. and M.S. in Electrical Engineering from the University of Virginia. Mr. Peeler has been nominated to continue serving on the Board because of his extensive experience in managing high-growth technology companies and his executive leadership of a publicly traded company with international operations andoperations. He has a wealth of knowledge about the service needs of customers in demanding markets, including semiconductor capital equipment. Thomas J. Seifert, nominee for director, has been the Executive Vice President and Chief Financial Officer of Symantec Corporation, a provider of security, backup and availability solutions, since March 2014. He served as Executive Vice President and Chief Financial Officer of Brightstar Corporation, a wireless distribution and services company, from December 2012 to March 2014. He was Senior Vice President and Chief Financial Officer at Advanced Micro Devices Inc., a semiconductor company, from October 2009 to August 2012, and served as Interim Chief Executive Officer from January 2011 to September 2012. From October 2008 to August 2009, Mr. Seifert served as Chief Operating Officer and Chief Financial Officer of Qimonda AG, a German memory chip manufacturer, and as Chief Operating Officer from June 2004 to October 2008. He also held executive positions at Infineon AG, White Oak Semiconductor, including the position as Chief Executive Officer, and Altis Semiconductor. Mr. Seifert has a Bachelor’s degree and a Master’s degree in Business Administration from Friedrich Alexander University and a Master’s degree in Mathematics and Economics from Wayne State University. Mr. Seifert has been nominated to serve on the Board because of his extensive experience as both an operating executive and chief financial officer of several large publicly held international technology businesses.

Standing Committees and Board Committee

MeetingsMembership

The Board has a standing Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee, each composed entirely of non-employee directors determined to be "independent" under the listing standards of the NASDAQ stock market. Under their written charters adopted by the Board, each of these committees is authorized and assured appropriate funding to retain and consult with external advisors, consultants and counsel.

The table below

showssets forth the directors who are currently members or chairs of each of the standing Board committees, and the number of meetings held by

each committee and the

full Board

and its committees, actions by written consent, as well as current committee memberships.in 2013. All incumbent directors attended 75% or more of the aggregate meetings of the Board and committees on which they served during

fiscal 2012.2013. We encourage directors to attend the annual meeting of stockholders, but we do not have a formal policy regarding such attendance. Last year, six of the directors in office attended the annual meeting.

| | | | | | | | |

| | | Board of

Directors | | Audit | | Compensation | | Nominating

and

Corporate

Governance |

Meetings held in 2012 | | 9 | | 6 | | 9 | | 7 |

Written consents in 2012 | | 4 | | — | | 3 | | 1 |

Valentin P. Gapontsev, Ph.D. | | Chair | | | | | | |

Robert A. Blair | | Member | | | | Chair | | Member |

Michael C. Child | | Member | | Member | | | | Chair |

Henry E. Gauthier | | Member, and presiding

independent director | | Member | | | | |

William S. Hurley | | Member | | Chair | | Member | | |

Michael R. Kampfe | | Member | | | | Member | | |

William F. Krupke, Ph.D. | | Member | | | | Member(1) | | Member |

John R. Peeler | | Member | | | | Member (2) | | |

Igor Samartsev | | Member | | | | | | |

Eugene Scherbakov, Ph.D. | | Member | | | | | | |

(1) | Dr. Krupke served as a member of the Compensation Committee until September 2012. |

(2) | Mr. Peeler began serving as a member of the Compensation Committee in September 2012. |

|

| | | | | | | | |

| | | Board of Directors | | Audit | | Compensation | | Nominating and Corporate Governance |

| Meetings held in 2013 | | 5 | | 7 | | 11 | | 8 |

| Written consents in 2013 | | 3 | | — | | — | | 1 |

| Valentin P. Gapontsev, Ph.D. | | Chair | | | | | | |

| Robert A. Blair | | Member | | | | Chair | | Member |

| Michael C. Child | | Member | | Member | | | | Chair |

| Henry E. Gauthier | | Member, and Presiding Independent Director | | Member | | | | |

| William S. Hurley | | Member | | Chair | | Member | | |

| William F. Krupke, Ph.D. | | Member | | | | | | Member |

| John R. Peeler | | Member | | | | Member | | Member |

| Igor Samartsev | | Member | | | | | | |

| Eugene Scherbakov, Ph.D. | | Member | | | | | | |

Standing CommitteesThe Audit Committee assists the Board by providing oversight of financial management, the BoardAudit Committee.internal auditor function and the independent auditor and providing oversight with respect to our internal controls including that management is maintaining an adequate system of internal control such that there is reasonable assurance that assets are safeguarded and that financial reports are properly prepared; that there is consistent application of generally accepted accounting principles; and that there is compliance with management’s financial reporting policies and procedures. The Audit Committee among other things:

appoints, approves the fees of, and assesses the independence of our independent registered public accounting firm;

oversees the work and performance of our independent registered public accounting firm and internal audit function, which includes the receipt and consideration of certain reports from the independent registered public accounting firm and internal audit function;

resolves disagreements between management and our independent registered public accounting firm;

also pre-approves auditing and permissible non-audit services and the terms of such services, to be provided by our independent registered public accounting firm;

auditor, reviews and discusses with management and our independent registered public accounting firm our annual and quarterly financial statements and related disclosures;

disclosures, and coordinates the oversight of our internal and external controls over financial reporting, disclosure controls and procedures and code of business conduct;

establishes, reviews and updates our code of business conduct;

establishes procedures forconduct. In performing these functions, the receipt of accounting-related complaints and concerns;

Audit Committee meets independentlyperiodically with ourthe independent registered public accounting firm,auditor, management and internal audit function;

preparesauditor function (including in private sessions) to review their work and confirm that they are properly discharging their respective responsibilities. In addition, the Audit Committee report required by SEC rules to be included in our proxy statements; and

performs any other activities as such committee orappoints the Board determines or is required byindependent auditor. A copy of the Company’s charter or by-laws or applicable law.

The Nominating and Corporate Governance Committee has determined that Mr. Hurley, Chair of the Audit Committee qualifiesis available on our website at http://investor.ipgphotonics.com/documents.cfm. For more information on Audit Committee activities in 2013, see the Audit Committee Report on page 40 of this proxy statement.

The Board has designated Mr. Hurley, the Chairman of the Audit Committee and an independent Director, as an “audit committee financial

expert,” as definedexpert” under the

Securities Exchange Act of 1934, as amended,rules and

the applicable rulesregulations of the

NASDAQ Global Market.SEC after determining that he meets the requirements for such designation. This determination was based on Mr. Hurley’s experience as chief financial officer at several publicly held companies, where he performed the functions of principal financial officer and principal accounting officer.

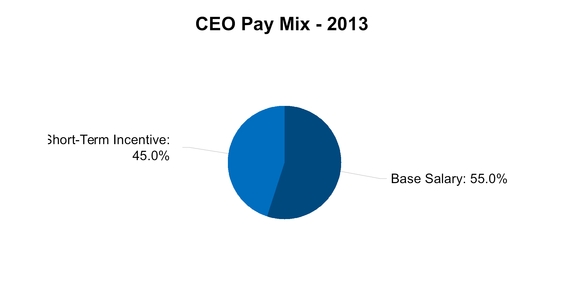

The primary function of the Compensation Committee.Committee is to discharge the Board’s duties and

responsibilities relating to compensation of our non-employee directors and executive officers, and oversee the design and management of the long-term incentive and savings plans that cover our employees. The Compensation

Committee, among other things:annually reviewsCommittee’s duties and approves base salary, short-termresponsibilities under its charter with respect to the compensation of our directors and long-term incentive compensation, perquisitesexecutive officers include:

reviewing and other benefits for ourapproving the Chairman and Chief Executive Officer and other officers;Officer’s compensation based on the annual evaluation of his or her performance with input from the independent directors;

reviews and approvesestablishing the corporate goals and objectives relevant to compensation of ourthe Chairman and Chief Executive Officer and other officers;

evaluates, along with input ofhis performance bonus. From 2014, the independent directors the performance of our Chief Executive Officer in light of ourwill establish and oversee these corporate goals and objectives and determinesprovide the compensationevaluation to the Compensation Committee which retains responsibility for determining the performance bonus of ourthe Chairman and Chief Executive Officer;

periodically reviewsreviewing and approving compensation practices, proceduresdecisions recommended by the Chairman and policies throughout the Company;

reviews and approves employment and severance agreements for our Chief Executive Officer for the other executive officers, including setting base salaries, annual performance bonuses, long-term incentive awards, severance benefits and other officers;

perquisites;appointssetting our compensation philosophy and approves the feescomposition of the group of peer companies used for comparison of executive compensation; and

reviewing, and recommending for approval by the Board, the compensation for the non-employee directors.

The Compensation Committee has retained an independent compensation consultant assistingfirm, Radford, a unit of Aon Hewitt ("Radford"), for matters related to executive officer and director compensation. Radford does not provide any other services to the Company. The compensation consultant reports directly to the Committee. The Compensation Committee also retains outside legal counsel to provide advice on compensation-related matters, including executive officers, directors and compensation plans. For further discussion of the role of the Compensation Committee in the evaluation of Chief Executive Officer, senior executivesexecutive compensation decision-making process, and director compensation, and obtains advice from legal, accounting and other advisors as it deems appropriate;

reviews and recommends to the Board compensation for non-employee membersa description of the Board;

administers Company equity-based compensation plans;

nature and scope of the consultant’s assignment, see “Compensation Discussion and Analysis - How Executive Compensation is Determined” on page 24 of this proxy statement. Additionally, the Compensation Committee reviews the Compensation Discussion and Analysis, prepares the Compensation Committee Report in this proxy statement on page 19 and oversees management’s risk assessment of the Company’s compensation policies and practices for all employees and oversees compensation-related risks as delegated by the Board;

reviewsBoard. A copy of the compensation discussion and analysis and preparescharter of the Compensation Committee Report required by SEC rules tocan be included infound on our proxy statement;

website at http://investor.ipgphotonics.com/documents.cfm.reviews the activities of the saving plan committee; and

performs any other activities as such committee or the Board determines or is required by the Company’s charter or by-laws or applicable law.

The Nominating and Corporate Governance Committee.Committee is responsible for overseeing matters of corporate governance, including the evaluation of the performance and practices of the Board. The Nominating and Corporate Governance Committee among other things:

develops and recommends criteria for Board membership, reviews possible candidates for the Board, as discussed on page 7 of this proxy statement, and recommends the nominees for directors to the Board criteria for board membership;

recommends toapproval. In addition, the Nominating and Corporate Governance Committee oversees the Board changes that the Committee believes to be desirable with regard to the appropriate size, functions and needsprocess for annual performance evaluations of the Board;

identifies and evaluates director candidates, including nominees recommended by our stockholders;

identifies individuals qualified to fill vacancies on any committeecommittees of the Board;

reviews procedures for stockholders to submit recommendations for director candidates;

recommends toBoard. It is also within the Board the persons to be nominated for election as directors and to eachresponsibilities of the Board’s committees;

reviews the performanceNominating and Corporate Governance Committee to review and recommend director orientation, stock ownership guidelines, delegation of theauthority to management, insider trading guidelines, and consider questions of possible conflicts of interest, including related party transactions, as such questions arise. The Nominating and Corporate Governance Committee and evaluates its charter periodically;

develops and recommends to the Board a set of corporate governance guidelines;

also reviews and recommends risk oversight responsibilities of the Board and committees;

reviewsits committees. A copy of the charter of the Nominating and approves related party transactions;

Corporate Governance Committee can be found on our website at http://investor.ipgphotonics.com/documents.cfm.oversees annual self-assessments by the Board and its committees; and

performs any other activities as such committee or the Board determines or is required by the Company’s charter or by-laws or applicable law

Compensation Committee Interlocks and Insider Participation

No member of our Compensation Committee is or has been an officer or employee of our Company or any of our subsidiaries.

The objectives for our non-employee director compensation program are to attract highly-qualified individuals to serve on our Board and align their interests with those of our stockholders. Our non-employee directors are paid pursuant to our non-employee director compensation plan described below. Our Compensation Committee reviews our director compensation program annually to confirm that the program remains appropriate and competitive and recommends any changes to our full Board for consideration and approval.

Director Compensation Plan

Our non-employee director compensation plan provides for both cash and equity compensation for our non-employee directors. Directors who are also our employees receive no additional compensation for their service as directors. The Compensation Committee engaged Radford,

a unit of Aon Hewitt (“Radford”), an independent compensation consultant

firm, to provide a comprehensive review of compensation for non-employee directors and to make recommendations with regard to director compensation matters.

Based upon a review in January 2012 by Radford, the Compensation Committee recommended no changes to non-employee director compensation in 2012.Cash Compensation.Our non-employee directors receive the annual retainers from us set forth in the table below. Directors do not receive separate fees for attending Board or committee meetings or meetings of stockholders.

|

| | | |

| | Amount |

| Board Retainer | $ | 40,000 |

|

| Presiding Independent Director Retainer | $ | 20,000 |

|

| Audit Committee Retainers | |

| Chair | $ | 22,500 |

|

| Non-Chair | $ | 10,000 |

|

| Compensation Committee Retainers | |

| Chair | $ | 20,000 |

|

| Non-Chair | $ | 7,500 |

|

| Nominating and Corporate Governance Committee Retainers | |

| Chair | $ | 12,500 |

|

| Non-Chair | $ | 5,000 |

|